Crypto ETF Fund Outflows: Is BlackRock and Other Issuers Still Making Money?

Original Article Title: When Wrappers Run Red

Original Article Author: Prathik Desai, Token Dispatch

Original Article Translation: Luffy, Foresight News

During the first two weeks of October 2025, Bitcoin spot ETFs saw inflows of $32 billion and $27 billion, setting records for the highest and fifth-highest weekly net inflows in 2025.

Prior to this, Bitcoin ETFs were on track to achieve a "no consecutive outflow week" milestone in the second half of 2025.

However, the most severe cryptocurrency liquidation event in history occurred unexpectedly. This event, which resulted in the evaporation of assets worth $190 billion, continues to haunt the crypto market.

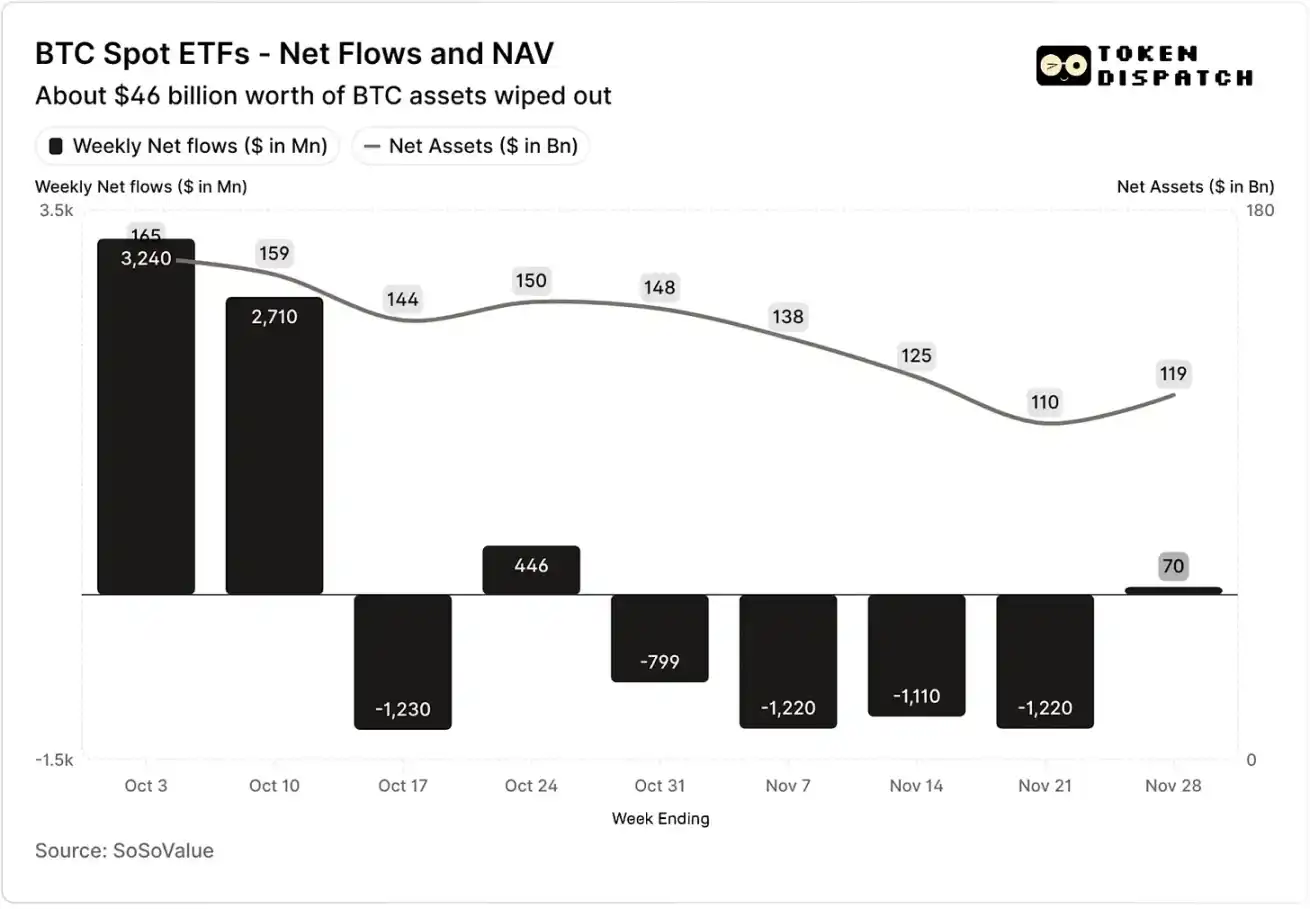

Net Fund Flows and Asset Net Value of Bitcoin Spot ETFs in October and November

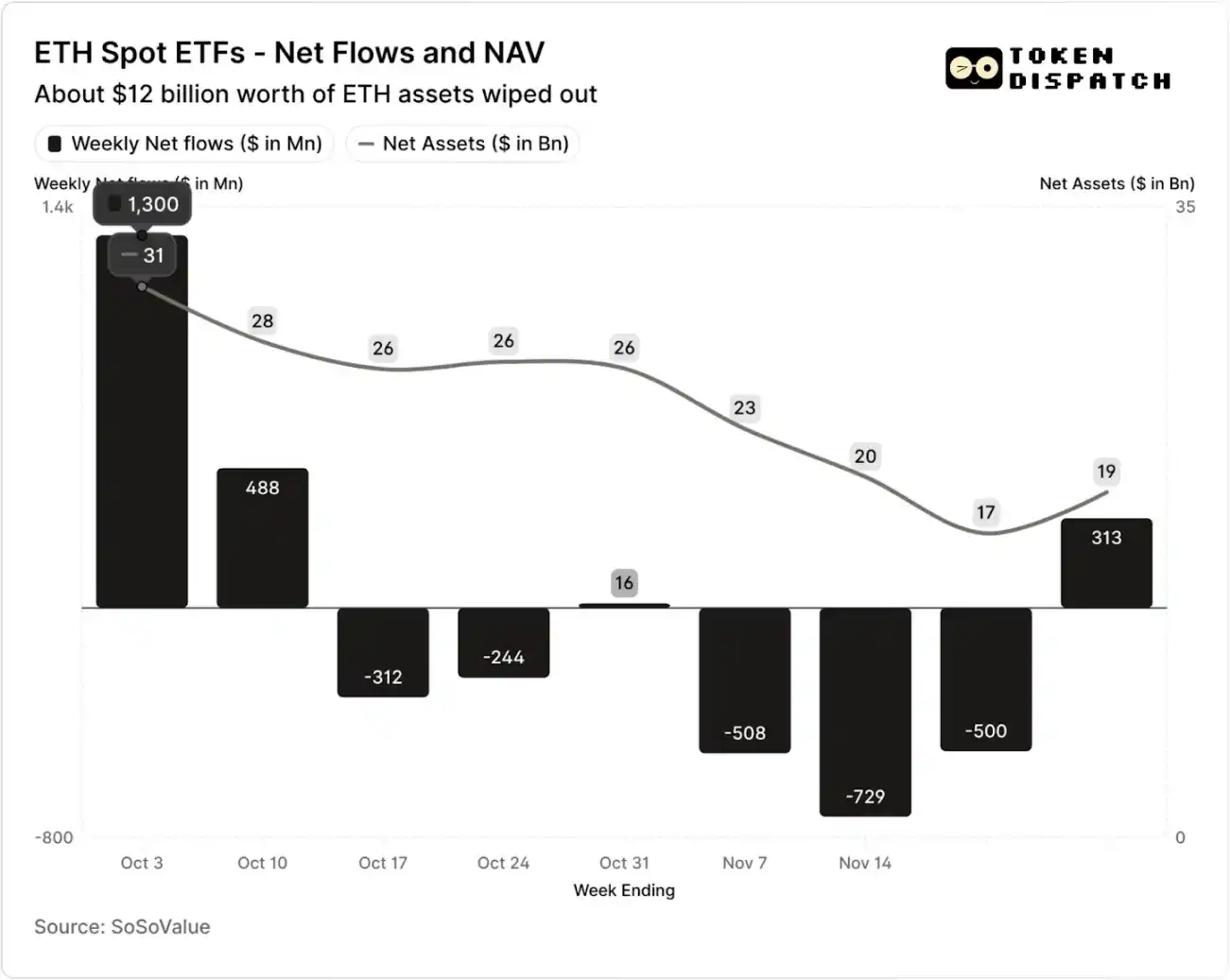

Net Fund Flows and Asset Net Value of Ethereum Spot ETFs in October and November

However, in the seven weeks following the liquidation event, Bitcoin and Ethereum ETFs experienced outflows in five weeks, totaling over $50 billion and $20 billion, respectively.

By the week ending November 21, the Net Asset Value (NAV) managed by the Bitcoin ETF issuer had shrunk from approximately $1.645 trillion to $1.101 trillion, while the Ethereum ETF's asset net value was nearly halved, dropping from $306 billion to $169 billion. This decline was partly due to the price decline of Bitcoin and Ethereum themselves, as well as some tokens being redeemed. In less than two months, the combined net asset value of Bitcoin and Ethereum ETFs evaporated by about one-third.

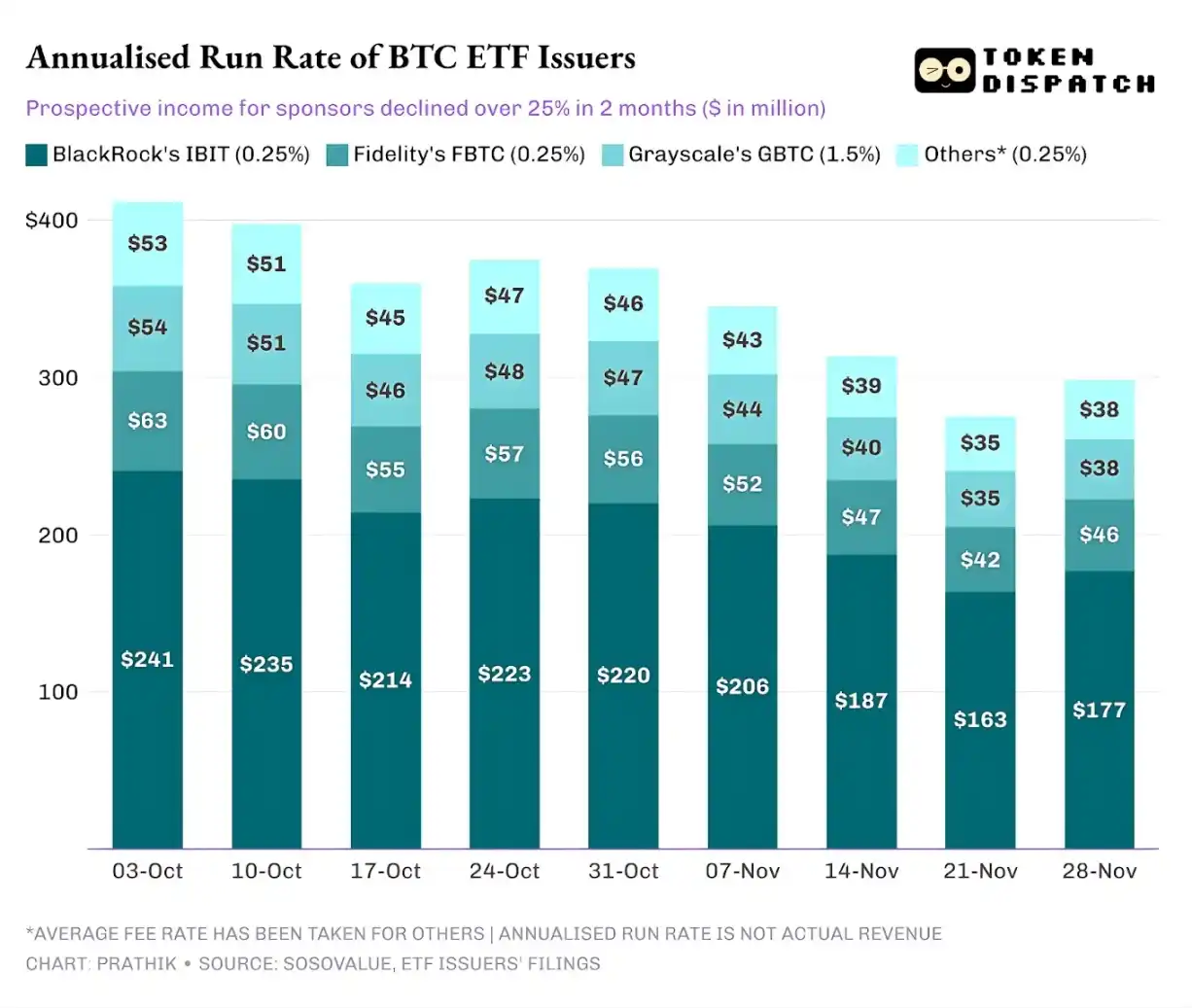

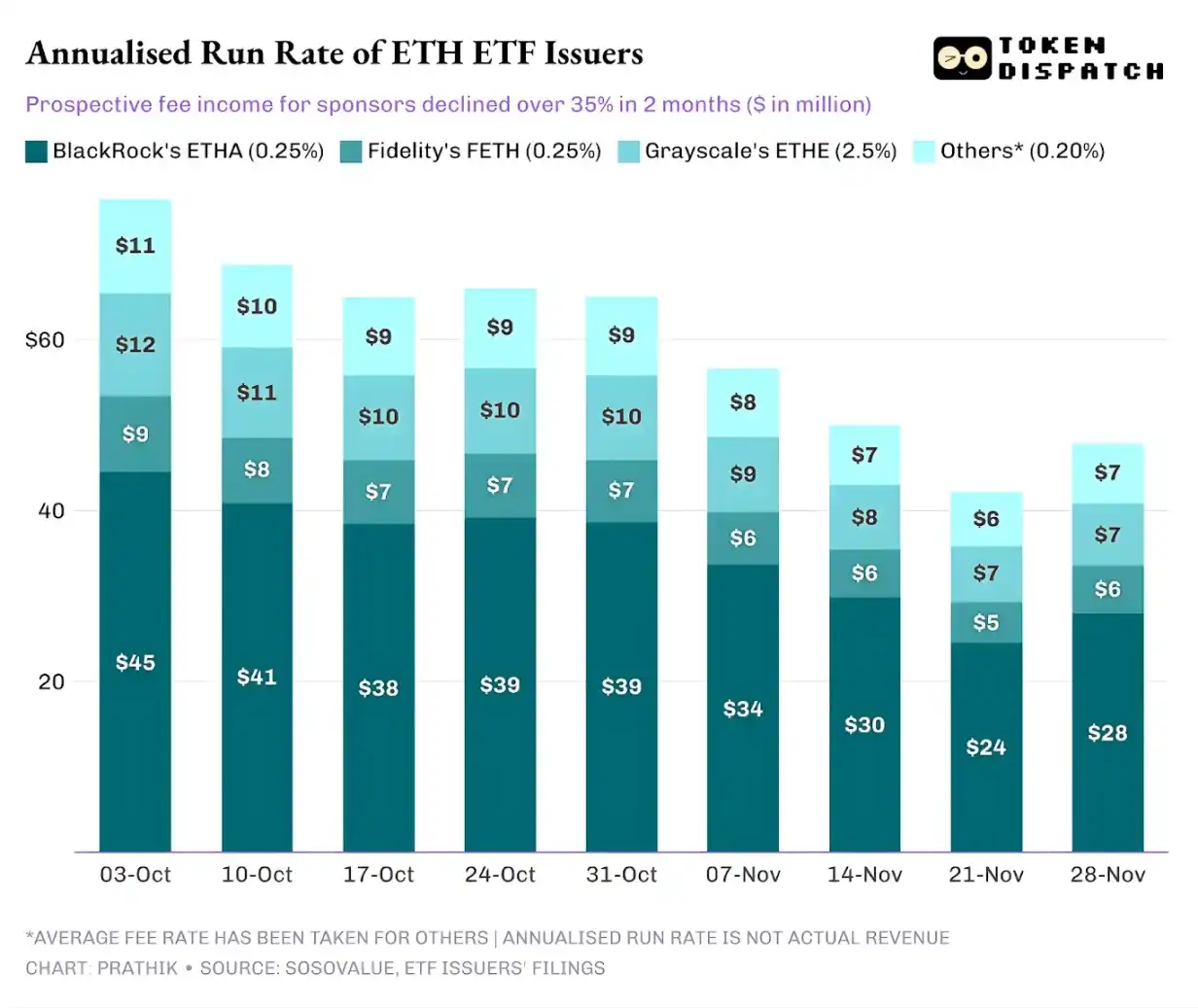

The retreat in fund flows reflects not only investor sentiment but also directly impacts the fee income of ETF issuers.

Bitcoin and Ethereum spot ETFs are the "money printers" of institutions like BlackRock, Fidelity, Grayscale, Bitwise, etc. Each fund charges fees based on the assets under management, typically expressed as an annual fee rate but actually accrued based on daily net asset value.

Every day, the trust funds holding Bitcoin or Ethereum shares will sell a portion of their holdings to cover transaction fees and other operational expenses. For the issuer, this means that their annual revenue is approximately equal to the Assets Under Management (AUM) multiplied by the fee rate; for the holders, this results in a gradual dilution of the amount of tokens held over time.

The fee rate range for ETF issuers is between 0.15% and 2.50%.

Redemption or outflows of funds themselves do not directly result in profit or loss for the issuer, but outflows cause a reduction in the issuer's ultimately managed asset size, thereby decreasing the asset base on which fees can be collected.

On October 3, the total assets under management by Bitcoin and Ethereum ETF issuers reached $195 billion, considering the aforementioned fee levels, their fee pool size was considerable. However, by November 21, the remaining asset size of these products was only about $127 billion.

If we calculate the annualized fee income based on the weekend's assets under management, over the past two months, the potential revenue for Bitcoin ETFs has declined by over 25%; Ethereum ETF issuers have been more significantly affected, with a 35% decline in annualized revenue over the past nine weeks.

The Larger the Issuance Scale, the Harder the Fall

From the perspective of a single issuer, there are three slightly different trends behind the flow of funds.

For BlackRock, its business characteristics involve a combination of "economies of scale" and "cyclical fluctuations." Its IBIT and ETHA have become the default choices for mainstream investors to allocate Bitcoin and Ethereum through an ETF channel. This has allowed the world's largest asset management institution to charge a 0.25% fee based on its large asset base, especially when the asset size hit a record in early October, the gains were substantial. However, this also means that when large holders decided to reduce risk in November, IBIT and ETHA became the most direct selling targets.

The data is sufficient to support this: BlackRock's Bitcoin and Ethereum ETFs saw annualized fee income declines of 28% and 38%, exceeding the industry average declines of 25% and 35%.

Vanguard's situation is similar to that of BlackRock, but on a relatively smaller scale. Its FBTC and FETH funds also followed the rhythm of "inflow first, outflow later," where the market enthusiasm in October was eventually replaced by outflows in November.

Grayscale's story is more about "historical legacy issues." Once upon a time, GBTC and ETHE were the only scaled channels for numerous U.S. investors to allocate Bitcoin and Ethereum through brokerage accounts. However, with institutions like BlackRock and Vanguard leading the market, Grayscale's monopoly position no longer exists. To make matters worse, the high fee structure of its early products has led to continued outflow pressure over the past two years.

The market performance in October and November also confirmed this investor tendency: when the market is bullish, funds will shift to lower-fee products; when the market weakens, positions will be significantly reduced.

The early Grayscale cryptocurrency products had a fee rate 6-10 times lower than low-cost ETFs. Although a high fee rate can boost revenue figures, the elevated cost will continuously drive investors away, diminishing the asset under management that generates fee income. The retained funds are often constrained by frictional costs such as taxation, investment mandates, operational processes, rather than stemming from active investor choices; and each outflow reminds the market: once a superior option arises, more holders will abandon high-fee products.

These ETF data unveil several key features of the current cryptocurrency institutionalization process.

The spot ETF market in October and November demonstrates that the cryptocurrency ETF management business is as cyclical as the underlying asset market. When asset prices rise and market sentiment is positive, inflows will drive up fee revenue; however, once the macro environment changes, funds will swiftly exit.

Although large issuance institutions have established efficient "fee channels" on Bitcoin and Ethereum assets, the volatility in October and November proves that these channels are also susceptible to market cycle impacts. For issuers, the core issue is how to retain assets in the face of a new market shock, avoiding significant fluctuations in fee revenue following macro trend changes.

While issuers cannot prevent investors from redeeming shares in a sell-off, income-generating products can to some extent mitigate downside risks.

Covered call option ETFs can provide investors with premium income (Note: A covered call option is an options trading strategy where an investor holds the underlying asset while simultaneously selling an equal number of call option contracts. Through collecting the premium, this strategy aims to enhance portfolio returns or hedge some risks.), offsetting some of the underlying asset price declines; collateralized products are also a viable direction. However, such products need to undergo regulatory review before being formally introduced to the market.

You may also like

Gold Plunges Over 4%, Silver Crashes 11%, Stock Market Plummet Triggers Precious Metals Algorithmic Selling Pressure?

Coinbase and Solana make successive moves, Agent economy to become the next big narrative

Aave DAO Wins, But the Game Is Not Over

Coinbase Earnings Call, Latest Developments in Aave Tokenomics Debate, What's Trending in the Global Crypto Community Today?

ICE, the parent company of the NYSE, Goes All In: Index Futures Contracts and Sentiment Prediction Market Tool

On-Chain Options: The Crossroads of DeFi Miners and Traders

How WEEX and LALIGA Redefine Elite Performance

WEEX x LALIGA partnership: Where trading discipline meets football excellence. Discover how WEEX, official regional partner in Hong Kong & Taiwan, brings crypto and sports fans together through shared values of strategy, control, and long-term performance.

Best Crypto to Buy Now February 10 – XRP, Solana, Dogecoin

Key Takeaways XRP is set to revolutionize cross-border transactions, potentially reaching $5 by the end of Q2 with…

Kyle Samani Criticizes Hyperliquid in Explosive Post-Departure Market Commentary

Key Takeaways: Kyle Samani, former co-founder of Multicoin Capital, publicly criticizes Hyperliquid, labeling it a systemic risk. Samani’s…

Leading AI Claude Forecasts the Price of XRP, Cardano, and Ethereum by the End of 2026

Key Takeaways: XRP’s value is projected to reach $8 by 2026 due to major institutional adoption. Cardano (ADA)…

Bitcoin Price Prediction: Alarming New Research Cautions Millions in BTC at Risk of ‘Quantum Freeze’ – Are You Ready?

Key Takeaways Quantum Threat to Bitcoin: The rise of quantum computing presents a unique security challenge to Bitcoin,…

XRP Price Prediction: Could XRP Ultimately Surpass Bitcoin and Ethereum?

Key Takeaways XRP has maintained a strong position despite a recent 12% drop, suggesting potential for growth. Analyst…

Best Crypto to Buy Now February 6 – XRP, Solana, Bitcoin

Key Takeaways The cryptocurrency market is experiencing pressure due to a technology-sector selloff, affecting digital assets like Bitcoin.…

South Korea Broadens Crypto Market Investigation Following Bithumb’s $44 Billion Bitcoin Error

Key Takeaways South Korea intensifies scrutiny on cryptocurrency exchange operations after Bithumb’s significant Bitcoin transaction error. Regulatory bodies,…

Tom Lee-Supported Bitmine Dominates 3.6% of Ethereum Supply Post-Price Crash

Key Takeaways Bitmine Immersion Technologies now controls 3.6% of Ethereum’s total supply after strategic purchases during market downturns.…

XRP Yearly Returns Hit Record Low Since 2023

Key Takeaways XRP’s yearly returns are at their lowest since 2023, as the crypto market grapples with a…

BTC Traders Eye $50K as Potential Bottom: Key Metrics to Monitor This Week

Key Takeaways Traders are closely monitoring the potential bottom for Bitcoin at $50,000 as recent price movements suggest…

Fraudulent ‘XRP’ Issued Token Sparks Confusion on the XRP Ledger

Key Takeaways An imposter XRP token is causing bewilderment within the XRP community by being superficially identical to…