Fast as lightning is not enough, what is the EVM chain really pushing for?

Original Title: Battle of the EVM Chains: Who's Winning the Giga Gas War?

Original Author: yusufxzy, Delphi_Digital Researcher

Original Translation: Dynamic Duo Deep

Editor's Note: The current focus of EVM-compatible chains (such as Sonic, MegaETH, Monad, Sei, Fuel) has shifted from decentralization and security to raw performance and ecosystem strategy. Each chain is competing in the market through differentiated paths (such as developer incentives, extreme speed, ecosystem pre-building, technical optimization, or Layer 2 innovation), but the ultimate winner must establish an advantage across comprehensive dimensions such as speed, user experience, economic model, and ecosystem maturity, rather than relying solely on throughput.

The following is the original content (rearranged for easier reading comprehension):

The blockchain space has entered a new dimension of competition. The early battle between L1 and L2 focused on decentralization, composability, and security. Now the battlefield has shifted to the raw performance track. Multiple EVM-compatible chains including Sonic, MegaETH, Fuel, Monad, and Sei are competing to break through the once-considered impossible scalability peak. But is raw performance the deciding factor? This article analyzes the strategic differences of these chains.

Sonic: Linking Developer Rewards to Ecosystem Contribution

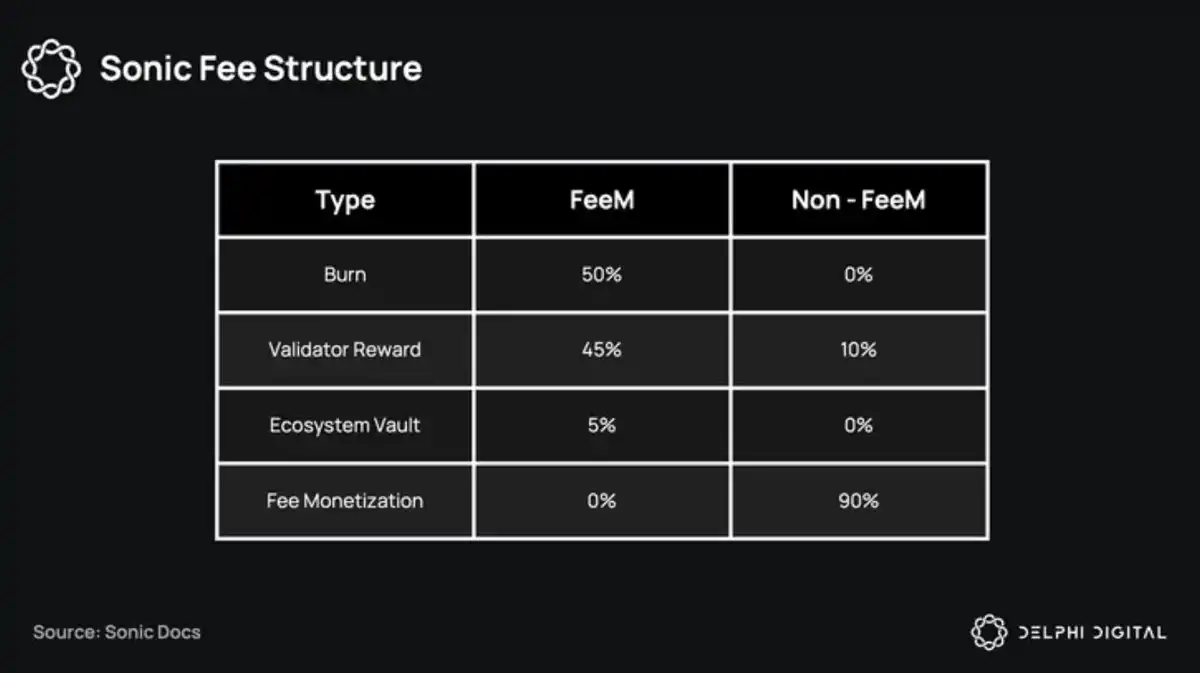

@SonicLabs (formerly Fantom) has completed a strategic transformation, and its core innovation, the "FeeM" mechanism, allocates 90% of transaction fees generated by applications to developers, with validators receiving only 10%.

This model has proven effective—ecosystem DEX project @ShadowOnSonic

has quickly risen to the Top 4 in weekly revenue rankings. Meanwhile, Sonic's dual incentives through DeFi app interactions and token airdrops have driven TVL to a historical high of $9.62 billion.

Competitive Advantage:

• Direct economic incentives linking to developer loyalty

• High-yield-driven application ecosystem stickiness

• Early adoption to validate the effectiveness of the metric verification model

Potential Challenge:

• Decentralization is still at a nascent stage (currently around 35-40 validator nodes)

• Continued development momentum is needed to eliminate the impact of Fantom's brand history

MegaETH: The Balancing Act of Ultimate Speed and User Experience

The @megaeth_labs testnet set a performance record of one gigagas per second with a 0.1 millisecond block time, leveraging its L2 architecture to achieve this breakthrough by abandoning the consensus mechanism.

But the chain's ambition goes beyond data: it is the first to experimentally support EIP-7702, addressing a historical pain point since 2020 where users have lost over $300 million due to approval operations through innovations such as transaction batching and Gas abstraction.

In terms of community building, MegaETH, with a valuation of $2 million, completed a public sale in 10 minutes, raising $10 million, followed by an NFT fundraising round reaching a $6 million valuation, starkly in contrast to VC financing.

Competitive Advantages:

• Industry-leading testnet performance metrics

• First-mover advantage in UX innovation (EIP-7702)

• Community consensus achieved through fair token distribution

Potential Challenges:

• Dependency on the EigenDA data availability layer

• Aggressive performance targets awaiting real-world validation

Monad: Building an Ecosystem Before Going Live

Although the @monad_xyz mainnet has not yet launched, it has already built a complete infrastructure matrix: on the first day, it integrated with the Phantom wallet, attracted top DeFi protocols like Uniswap/Balancer, and integrated cross-chain solutions like LayerZero.

This "plug-and-play" strategy can be seen as a force multiplier in today's crowded blockchain space.

Competitive Advantages:

• Ready-to-use ecosystem infrastructure

• Launch-ready with high liquidity channels

Key Challenge:

• Need to transform early momentum into sustained growth

Sei: The Disruptive Challenge of Tech Prodigies

@SeiNetwork has achieved an internal scalability breakthrough through deep optimization of the consensus and storage layers, along with injecting funding into early developers. However, the current ecosystem still lacks flagship applications, struggles with user adoption and faces competition gaps, as its technical advantages have yet to translate into market influence.

Competitive Advantage:

• Proven scalability technology architecture

• Specialized grant programs for builders

Key Challenge:

• Low actual adoption rates

• Urgent need to create a phenomenon-level application

Fuel: Breaking Free from Ethereum's DA Shackles

@fuel_network's upcoming "Redacted" L2 adopts an alternative DA solution, aiming to achieve a throughput of 150,000 TPS, marking a strategic shift from Ethereum compatibility to performance prioritization. Its vision of 1-millisecond confirmations and 400,000 orders per second will redefine the performance benchmark for public chains.

Endgame Perspective: The Value War Beyond Throughput

While the market value of these tokens is still to be observed, the current L1 and L2 race has become saturated. With intense competition among chains in terms of liquidity, applications, developers, and users, valuations may show a downward trend.

As gas in the gigabyte range becomes the norm, the real winners will be those that can offer a higher value public chain, including speed advantages, incentive mechanisms, user experience, ecosystem completeness, and security guarantees among other comprehensive strengths. The gigabyte gas war is intensifying, but the ultimate key to victory is by no means limited to raw throughput.

You may also like

February 9th Market Key Intelligence, How Much Did You Miss?

After being questioned by Vitalik, L2s are collectively saying goodbye to the "cheap" era

WEEX AI Trading Hackathon Paris Workshop Reveals: How Retail Crypto Traders Can Outperform Hedge Funds

Witness how WEEX's Paris AI Trading Hackathon revealed AI's edge over human traders. Explore key strategies, live competition results & how to build your own AI trading bot.

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

USOR vs Oil ETFs: Understanding Why the ‘Oil Reserve’ Token Doesn’t Track Crude Prices

Key Takeaways The U.S. Oil Reserve (USOR) token has become noteworthy for its claims, yet it does not…

Trend Research Reduces Ether Holdings After Major Market Turbulence

Key Takeaways: Trend Research has significantly cut down its Ether holdings, moving over 404,000 ETH to exchanges recently.…

Investors Channel $258M into Crypto Startups Despite $2 Trillion Market Sell-Off

Key Takeaways: Investors pumped approximately $258 million into crypto startups in early February, highlighting continued support for blockchain-related…

NBA Star Giannis Antetokounmpo Becomes Shareholder in Prediction Market Kalshi

Key Takeaways: Giannis Antetokounmpo, the NBA’s two-time MVP, invests in the prediction market platform Kalshi as a shareholder.…

Arizona Home Invasion Targets $66 Million in Cryptocurrency: Two Teens Charged

Key Takeaways Two teenagers from California face serious felony charges for allegedly attempting to steal $66 million in…

El Salvador’s Bukele Approval Reaches Record 91.9% Despite Limited Bitcoin Use

Key Takeaways: El Salvador President Nayib Bukele enjoys a record high approval rating of 91.9% from his populace,…

Crypto Price Prediction for February 6: XRP, Dogecoin, and Shiba Inu’s Market Movements

Key Takeaways: The crypto market experienced a notable shift with Bitcoin’s significant surge, impacting altcoins like XRP, Dogecoin,…

China Restricts Unapproved Yuan-Pegged Stablecoins to Maintain Currency Stability

Key Takeaways: China’s central bank and seven government agencies have banned the issuance of yuan-pegged stablecoins abroad without…

Solana Price Prediction: $80 SOL Looks Scary – But Smart Money Just Signaled This Might Be the Bottom

Key Takeaways Despite Solana’s descent to $80, some traders find security as smart money enters the fray, suggesting…

XRP Price Prediction: Major Ledger Upgrade Quietly Activated – Why This Could Be the Most Bullish Signal Yet

Key Takeaways: The activation of the Permissioned Domains amendment on XRPL represents a significant development in XRP’s potential…

Dogecoin Price Prediction: Death Cross Confirmed as DOGE Falls Below $0.10 – Is DOGE Reaching Zero?

Key Takeaways The death cross event signals potential bearish trends for Dogecoin as its price dips under $0.10,…

Stablecoin Inflows Have Doubled to $98B Amid Selling Pressure

Key Takeaways Stablecoin inflows to crypto exchanges have surged to $98 billion, doubling previous levels amidst heightened market…

February 9th Market Key Intelligence, How Much Did You Miss?

After being questioned by Vitalik, L2s are collectively saying goodbye to the "cheap" era

WEEX AI Trading Hackathon Paris Workshop Reveals: How Retail Crypto Traders Can Outperform Hedge Funds

Witness how WEEX's Paris AI Trading Hackathon revealed AI's edge over human traders. Explore key strategies, live competition results & how to build your own AI trading bot.

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

Earn

Earn