Solana Validator Shake-Up: Foundation Aims for Decentralization, Half Validators Face Survival Test

Original Article Title: "Solana Validators Facing a Turning Point: Foundation Aims for Decentralization, Half of Validators Facing Survival Test"

Original Article Author: Frank, PANews

As the SOL ETF gains institutional traction, the Solana ecosystem appears to be accelerating its reform towards decentralized governance. On April 23, the Solana Foundation introduced a new policy that, for each new validator added to the Solana Foundation Delegation Plan (SFDP), three validators will be removed if certain validators have been eligible for Solana Foundation delegation on the mainnet for at least 18 months and have staked less than 1000 SOL outside of the Solana Foundation delegation. Behind these policies is an attempt to increase validator independence by reducing their reliance on the foundation. However, the ultimate result may still be the optimization of a large number of small and medium-sized nodes.

"One In, Three Out" Optimizing Validator Structure

The most notable part of the new policy is its "one in, three out" replacement rule. Specifically, for each new validator added to the Solana Foundation Delegation Plan (SFDP), three existing validators will be removed.

The eligibility criteria for removal are very clear and include two key conditions. First, the validator must have been eligible for foundation delegation for at least 18 months, and second, the validator's external stake outside of the foundation delegation must be less than 1000 SOL. These two conditions precisely target those validators who have been involved in the delegation plan for the long term but have failed to prove their independent survival capability by attracting community support.

It is worth noting that this policy took effect immediately upon announcement, demonstrating the Solana Foundation's urgent push for the decentralization of the Solana network.

Impact May Involve Half of Validators

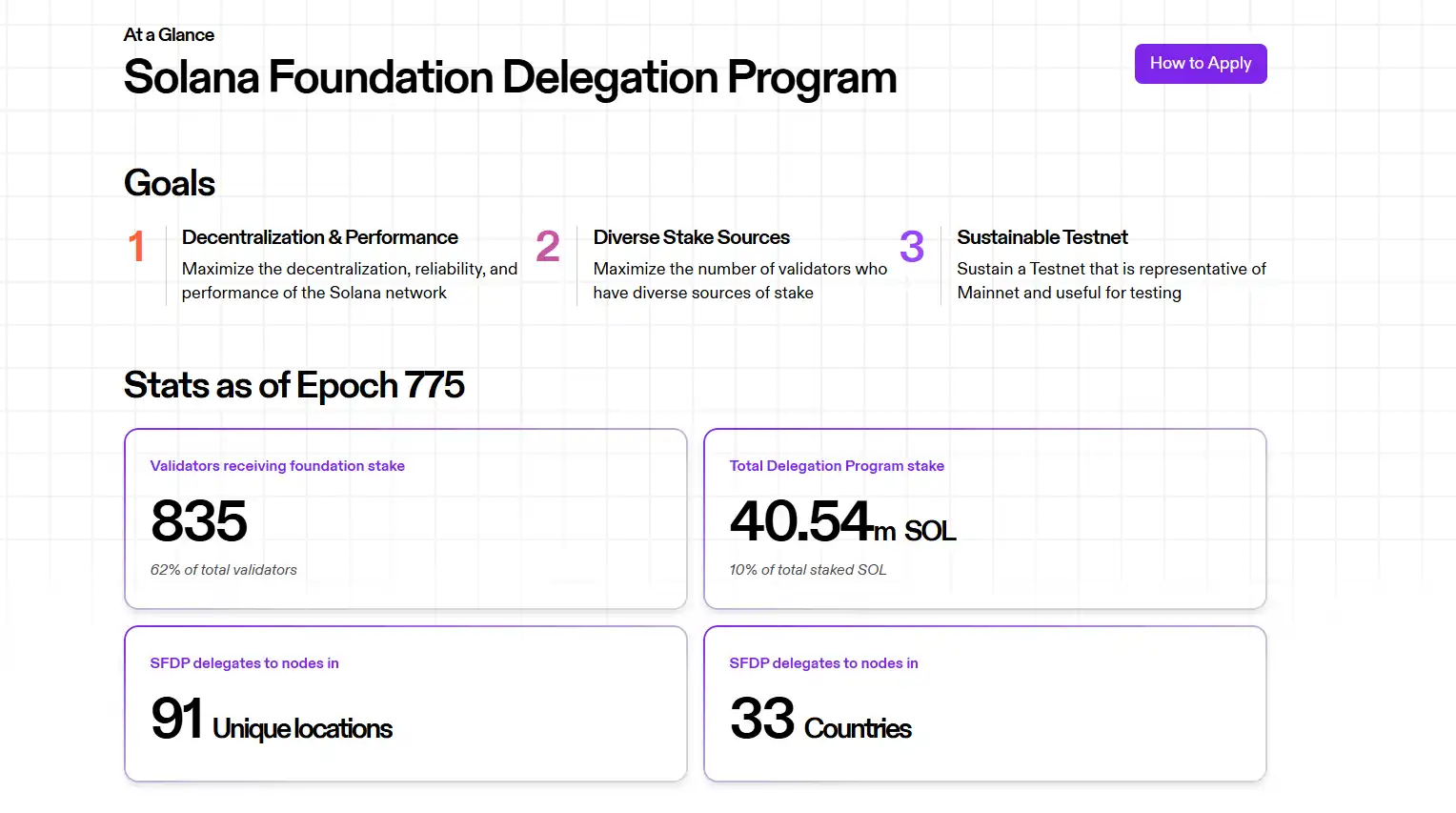

According to official data, as of April 24, there are currently 835 validators receiving the foundation's delegation through SFDP, accounting for 62% of the total number of Solana network validators. The total amount of SOL delegated through this plan is around 40.5 million SOL, accounting for 10% of the total staked SOL on the Solana network.

Based on data from a report by Helius at the end of August 2024, approximately 51% of validators have an external stake of less than 1000 SOL. If this proportion remains relatively stable, the current number of validators meeting the criteria is approximately 686. In the future, under the impact of this policy, these validators may be forced to exit the validator ranks if they fail to attract more SOL stakes. The significant impact is mainly because many validators rely on the Solana Foundation's SFDP plan for their survival.

As for why foundation support directly relates to the life or death of many validators, let's review the SFDP plan once again. The Solana Foundation Delegation Plan (SFDP) is one of the core mechanisms supporting the validator network's development in the Solana ecosystem. The establishment of this plan was originally intended to guide growth in the early stages of the network, reduce the entry barriers for validators, particularly by providing foundational delegation to help validators with less capital participate in consensus, earn rewards, and thereby promote the growth of the validator count and overall network security.

The SFDP provides support to validators in various ways:

1. Stake Matching: This is a key mechanism incentivizing validators to attract external stake. The Foundation will match the stake obtained by validators on a 1:1 basis, with a maximum matching amount of 100,000 SOL. However, this matching is not unlimited. Once a validator's external stake exceeds 1 million SOL, the Foundation will no longer provide any delegation (including matching and residual delegation).

2. Residual Delegation: After completing all eligible stake matches, the remaining SOL in the SFDP fund pool will be evenly distributed among all other eligible validators. According to Helius's analysis, this remaining delegation is currently approximately 30,000 SOL per validator. However, the Foundation has indicated that this portion of residual delegation is expected to gradually decrease as it increases its stake in community-operated pools.

3. Voting Cost Assistance: Running a Solana validator requires ongoing payment of voting transaction fees, which is a significant expense for new or small-staked validators (around 1.1 SOL per day). To alleviate this initial burden, the SFDP offers a time-limited voting cost subsidy program. For new mainnet validators applying for this support, the Foundation covers 100% of the voting costs for the first 45 epochs (approximately 3 months) after joining the program, then reduces the coverage by 25% every 45 epochs until it stops subsidizing after 180 epochs (around 1 year).

Is Solana Trapped in a Centralization Cycle of Reform?

According to Laine's estimate for the year 2024, a validator needs a stake of at least 3,500 SOL to balance the voting fees, not including server costs of over $45,000 per year. Therefore, it can be said that if the SFDP plan is enforced, a large number of small validators may only be left with the option to shut down.

However, fortunately, this plan has two external conditions: having been part of the SFDP program for 18 months and the SFDP needing to add a new validator. This also serves as a grace period for validators who do not meet the criteria.

From a design perspective, this plan aims to reduce validators' reliance on the Solana Foundation, enhance validator independence and community support, and alleviate external concerns about the foundation's excessive influence on the ecosystem. However, looking at the potential outcomes, if, after the removal of validators, an insufficient number or quality of new validators can't promptly fill the vacancies, or if the new validators themselves struggle to survive in the competitive environment, the total number of network validators could decrease, undermining decentralization instead.

On April 22, Paul Atkins was sworn in as the new Chairman of the U.S. SEC. As a crypto-friendly Chairman, he will have 72 crypto-related ETFs awaiting approval. Although many of them may face challenges in approval, SOL, which is one of the most vocal tokens, is likely to be among those approved. Looking at the timeline, the final approval dates for SOL are mostly concentrated in October 2025. However, similar to the reasons Ethereum's upgrades were frequently delayed in the past, Solana is facing a crucial issue currently: the lack of decentralization, which could lead to a securities classification. Hence, actively promoting decentralization may be one of Solana's network's main current priorities.

On the other hand, as more institutional recognition emerges in the market, Solana's network may see an increasing number of large validators joining. On April 23, the Canadian securities exchange-listed company SOL Strategies announced securing up to a $500 million convertible note financing, specifically to purchase SOL and stake it in the company's operated validator node. Similarly, on the same day, the U.S.-listed company DeFi Development Corporation announced increasing its SOL holdings to 317,000 tokens, planning to participate in staking for long-term rewards.

Ultimately, whether it's the previously overturned SIMD-0228 proposal, the current Solana Foundation's "new policy," or the growing institutional participation, it seems that the direct consequence is the discouragement of small and medium validators, indicating a rising barrier to entry. This outcome does not seem beneficial for advancing decentralization. For Solana, lowering the validator threshold may be the true attitude towards advancing decentralization.

You may also like

Kyle Samani's Exit Scam, Is There More to the Story?

February 10th Market Key Intelligence, How Much Did You Miss?

Tokenomics New Paradigm? When Backpack Starts Enabling VCs to "Deferred Gratification"

BankrCoin Achieves New Milestones as YZi Labs and ETH Investors Make Significant Moves

Key Takeaways BankrCoin (BNKR) hit a new all-time high with significant market activity. YZi Labs executed a major…

Bitcoin Tests $75K Amid Market Predictions

Key Takeaways Bitcoin shows a 47% chance to test the $75,000 mark this February, contrasting with a potential…

MrBeast Acquires Step to Enhance Financial Offerings for Youth

Key Takeaways YouTube star MrBeast has acquired the financial services platform Step through Beast Industries. The acquisition aims…

Polymarket Predicts Bitcoin Uptrend as MrBeast Ventures into Fintech

Key Takeaways Bitcoin’s Potential Surge: Polymarket denotes a fluctuating probability of Bitcoin achieving $75,000 in February, reflecting volatile…

MrBeast Enters Financial Services with Step Acquisition

Key Takeaways Binance announced an Alpha Airdrop event, highlighting the growing trend of gamified airdrops. Bitcoin prediction markets…

Analysts Predict Bitcoin May Fall to $55K as Support Levels Threaten

Key Takeaways Analysts suggest a potential drop of Bitcoin to $55K if current support levels are breached. Galaxy…

Analysts Predict Bitcoin May Drop to $55K Amid Support Challenges

Key Takeaways Experts caution that Bitcoin could fall to $55,000 if current support levels are breached. The market…

Bitcoin May Decline to $55K: Analysts Warn

Key Takeaways Analysts project Bitcoin could drop to $55,000 if key support levels fail. Technical analysts forecast that…

YZI Labs Transfers Massive ID Tokens to Binance as BNKR Hits New High

Key Takeaways BNKR, a digital currency, has achieved its highest-priced milestone of $0.295 CAD as of January 26,…

MrBeast Acquires Step, Expanding Influence in Teen Finance Market

Key Takeaways MrBeast has acquired the financial services app Step, which caters specifically to Gen Z users. Step…

Analysts Predict Bitcoin’s Critical Support Level May Trigger Decline

Key Takeaways Experts indicate a crucial moment for Bitcoin, with potential price drop to $55,000 if support fails.…

Michael Saylor Faces Bitcoin Valuation Challenges: Impact on the Crypto Market

Key Takeaways Michael Saylor’s Bitcoin investment is currently valued at $55 billion, but recent market trends have seen…

MrBeast Acquires Step FinTech App in Strategic Move

Key Takeaways MrBeast’s company, Beast Industries, has announced the acquisition of Step, a fintech app focused on Gen…

Bitcoin’s Potential Surge Sparks Debate Among Investors

Key Takeaways The probability that Bitcoin will reach $75,000 in February fluctuates as predicted by Polymarket. Bitcoin recently…

Analysts Predict Bitcoin’s Potential Plunge to $55K

Key Takeaways Analysts warn of a possible drop to $55K if Bitcoin’s current support breaks. 10X Research and…

Kyle Samani's Exit Scam, Is There More to the Story?

February 10th Market Key Intelligence, How Much Did You Miss?

Tokenomics New Paradigm? When Backpack Starts Enabling VCs to "Deferred Gratification"

BankrCoin Achieves New Milestones as YZi Labs and ETH Investors Make Significant Moves

Key Takeaways BankrCoin (BNKR) hit a new all-time high with significant market activity. YZi Labs executed a major…

Bitcoin Tests $75K Amid Market Predictions

Key Takeaways Bitcoin shows a 47% chance to test the $75,000 mark this February, contrasting with a potential…

MrBeast Acquires Step to Enhance Financial Offerings for Youth

Key Takeaways YouTube star MrBeast has acquired the financial services platform Step through Beast Industries. The acquisition aims…