The DEX aggregation product has hit the pause button, OKX is feeling a bit unjustified in this wave

On March 17, OKX officially announced that, after consultation with regulatory agencies, it had voluntarily decided to temporarily suspend its DEX Aggregator service. As a result, related limit orders and cross-chain orders will be automatically canceled. OKX stated that the specific resumption time will depend on the upgrade progress. During this period, users can still trade by redirecting to third-party protocols, while other services of the OKX Web3 wallet remain unaffected.

According to community feedback, some trading bots that have integrated OKX DEX API experienced intermittent failures in EVM transactions (BSC, ETH).

Meanwhile, Binance Wallet announced that all transactions in the Binance Web3 wallet will enjoy zero transaction fees for the next 6 months. Clearly, a silent war over on-chain products of trading platforms has begun.

Tightening Cryptocurrency Regulation Atmosphere in Europe

At the time of the suspension of OKX DEX service, its Web3 service was under scrutiny by EU regulatory authorities.

On March 11, according to Bloomberg, sources mentioned that European cryptocurrency regulatory agencies are reviewing the usage of a service provided by OKX, where hackers used the service to launder funds stolen from the Bybit exchange.

Subsequently, OKX responded to Bloomberg stating that the report was misleading. OKX, as an aggregator, provides self-hosted wallet services/exchange functions aimed at creating efficiency for users. It emphasized that its Web3 wallet service is no different from services offered by other industry participants. OKX also revealed that after the Bybit hack, it froze related funds from entering centralized exchanges (CEX) and implemented new features to block hacker addresses from using its DEX or wallet services.

OKX firmly stated that it was not under investigation, and the incident was merely a case of a lack of security knowledge at Bybit. In today's announcement of the temporary suspension of the DEX service, this possibility was attributed to "service upgrade."

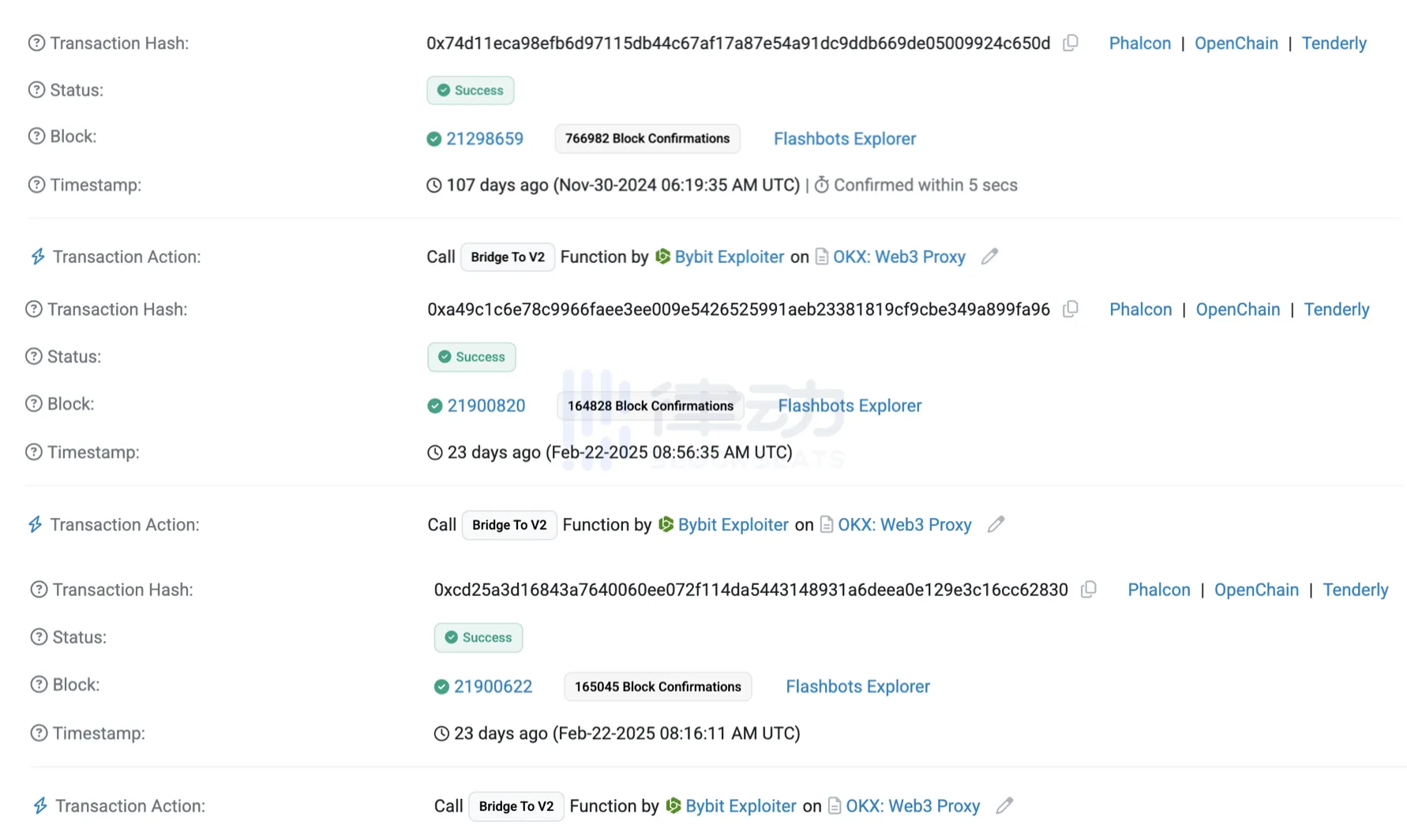

During the drafting process, BlockBeats found several transactions on-chain involving hacker addresses using OKX DEX services.

Hacker addresses using OKX DEX service; Image Source: BlockBeats

Furthermore, on Arkham, it can be seen that the Lazarus Group conducted $250 million in transactions using OKX DEX in the past month.

The regulatory pressure facing OKX is not unfounded. Globally, the cryptocurrency industry is facing an increasingly strict regulatory environment. François Villeroy, Governor of the Bank of France, publicly stated on March 17 that the U.S.' embrace of cryptocurrency could trigger another financial crisis. He pointed out that "financial crises often start in the United States and then spread to other parts of the world. By encouraging cryptocurrency and non-bank finance, the U.S. government is sowing the seeds of future turmoil."

On the same day, European Central Bank board member Villeroy de Galhau, in an interview with the French newspaper "Le Journal du Dimanche," stated that "by promoting the development of crypto assets and non-bank finance, the U.S. government is planting the seeds of future turbulence."

It can be said that the European region's cryptocurrency regulation has always been under high pressure. Currently, only OKX and Crypto.com have obtained licenses under the EU's Markets in Crypto-Assets Regulation (MiCA), both obtained in Malta. Many exchanges, including Binance, Bybit, and Kraken, are still in the application process.

Tornado Cash Founder Arrested, Thorchain Leader Dismissed, DeFi and Regulatory Struggles Never Cease

OKX being investigated due to the Bybit hacker transferring funds mirrors the situations where Tornado Cash, Thorchain, and others faced regulatory pressure related to hackers transferring funds and money laundering.

In April 2023, the U.S. Department of the Treasury released an assessment report on illicit financial activities in DeFi, revealing potential risks within DeFi services and analyzing how bad actors exploit these services for criminal activities. Three months later, four U.S. senators introduced the "Cryptocurrency National Security Enhancement and Enforcement Act," which aims to enhance regulation in the KYC, AML, and DeFi spaces.

The "Cryptocurrency National Security Enhancement and Enforcement Act" presents a new framework for regulating DeFi, requiring DeFi regulation similar to other cryptocurrency institutions and mandating accountability for any “person” who controls the project. The bill may mention that if there is no specific person in control of the DeFi service, then any investor putting more than $250,000 into the project should be held accountable.

In August 2023, the U.S. Department of the Treasury's Office of Foreign Assets Control sanctioned Roman Semenov, one of the three founders of the Tornado Cash cryptocurrency mixer, for providing substantial support to the nation-state hacker group Lazarus Group, concealing hundreds of millions of dollars in cryptocurrency theft. In May 2024, a Dutch judge ruled that Alexey Pertsev had committed money laundering and sentenced Pertsev to 64 months in prison.

The recent Bybit hack not only affected the OKX DEX but also another DeFi protocol, THORChain. The primary method of money laundering by the Bybit hacker was to convert ETH to BTC through THORChain, bringing in a huge amount of trading volume and fees to THORChain. On February 27, according to CypherTrace, the Bybit hacker's money laundering had already brought $29.1 billion in trading volume and $3 million in fee income to THORChain in a short period of time.

On February 28, THORChain's lead developer, Pluto, announced his resignation, making it difficult to say that this is unrelated to the hacker's use of THORChain to transfer funds. This also aligns with the principles advocated by the "Cryptocurrency and National Security Act" that DeFi protocols should have responsible "persons" controlling the project.

These protocol and regulation-related cases bring us back to that classic question—If someone uses a kitchen knife to stab someone, is the knife seller guilty?

Previously, Wang Xin, the founder of Kuai Bo, who was arrested for Kuai Bo becoming a platform for spreading obscene content, appeared on BlockBeats Space. He expressed that as a product receives more and more attention, developers' social responsibility also increases. He believes that developers should proactively embrace regulation and implement preventive mechanisms in advance. The "Kitchen Knife Argument" and "Match Argument" seem more like defending developers, proposing a relatively neutral "Car Argument."

The automotive industry has developed for many years. In the early days, the earliest users were limited to racers and enthusiasts, where driving was all about speed. But today, cars are commonplace, and besides improving speed, automakers have done a lot of other work, such as safety. Cars cannot run too fast. From an engine performance perspective, cars can reach speeds of over 300 kilometers per hour, but in reality, many cars cannot. Automakers impose these restrictions to prevent speeding-related accidents. The "Car Argument" is closer to reality. Developers need to design in advance and embrace regulation to address more real-world issues.

Perhaps from this perspective, we can understand OKX's decision to temporarily suspend DEX services for an upgrade.

How does the community view this?

As the current largest and most important on-chain wallet gateway, the suspension of OKX DEX services has sparked widespread discussion in the community.

Some believe that licensing is not a one-time thing, and it is still necessary to continue to comply with licensing requirements, facing significant compliance pressures, and there may be a possibility of spinning off Web3 business under the Mica license in the future. Meanwhile, regarding licensing, some crypto enthusiasts point out that obtaining a license only signifies two deterministic things: 1. You are willing to accept regulation; 2. Your compliance costs increase significantly.

According to insiders, major exchanges are currently undergoing rectification regarding regulatory issues, mainly including splitting the exchange's wallet into an independent app; wallet apps no longer come with DEX and cross-chain functionalities, no longer provide CeDeFi official financial management, and completely isolating the issuer and operator from the exchange platform.

After taking office, Trump's pro-crypto administration successively revoked the previous SEC's accusations against crypto companies such as Coinbase, Uniswap, and Ripple, and the U.S. crypto regulatory environment also became a stimulant for market sentiment at one point. Therefore, the community optimistically believes that the EU's regulatory action against OKX will also be relaxed.

Furthermore, the community speculates that the most likely to happen is the separation of OKX DEX and CEX businesses, and following Binance's Web3 wallet model to conduct user KYC, which, under the direction of compliance, is considered a strategic move.

You may also like

After being questioned by Vitalik, L2s are collectively saying goodbye to the "cheap" era

WEEX AI Trading Hackathon Paris Workshop Reveals: How Retail Crypto Traders Can Outperform Hedge Funds

Witness how WEEX's Paris AI Trading Hackathon revealed AI's edge over human traders. Explore key strategies, live competition results & how to build your own AI trading bot.

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

USOR vs Oil ETFs: Understanding Why the ‘Oil Reserve’ Token Doesn’t Track Crude Prices

Key Takeaways The U.S. Oil Reserve (USOR) token has become noteworthy for its claims, yet it does not…

Trend Research Reduces Ether Holdings After Major Market Turbulence

Key Takeaways: Trend Research has significantly cut down its Ether holdings, moving over 404,000 ETH to exchanges recently.…

Investors Channel $258M into Crypto Startups Despite $2 Trillion Market Sell-Off

Key Takeaways: Investors pumped approximately $258 million into crypto startups in early February, highlighting continued support for blockchain-related…

NBA Star Giannis Antetokounmpo Becomes Shareholder in Prediction Market Kalshi

Key Takeaways: Giannis Antetokounmpo, the NBA’s two-time MVP, invests in the prediction market platform Kalshi as a shareholder.…

Arizona Home Invasion Targets $66 Million in Cryptocurrency: Two Teens Charged

Key Takeaways Two teenagers from California face serious felony charges for allegedly attempting to steal $66 million in…

El Salvador’s Bukele Approval Reaches Record 91.9% Despite Limited Bitcoin Use

Key Takeaways: El Salvador President Nayib Bukele enjoys a record high approval rating of 91.9% from his populace,…

Crypto Price Prediction for February 6: XRP, Dogecoin, and Shiba Inu’s Market Movements

Key Takeaways: The crypto market experienced a notable shift with Bitcoin’s significant surge, impacting altcoins like XRP, Dogecoin,…

China Restricts Unapproved Yuan-Pegged Stablecoins to Maintain Currency Stability

Key Takeaways: China’s central bank and seven government agencies have banned the issuance of yuan-pegged stablecoins abroad without…

Solana Price Prediction: $80 SOL Looks Scary – But Smart Money Just Signaled This Might Be the Bottom

Key Takeaways Despite Solana’s descent to $80, some traders find security as smart money enters the fray, suggesting…

XRP Price Prediction: Major Ledger Upgrade Quietly Activated – Why This Could Be the Most Bullish Signal Yet

Key Takeaways: The activation of the Permissioned Domains amendment on XRPL represents a significant development in XRP’s potential…

Dogecoin Price Prediction: Death Cross Confirmed as DOGE Falls Below $0.10 – Is DOGE Reaching Zero?

Key Takeaways The death cross event signals potential bearish trends for Dogecoin as its price dips under $0.10,…

Stablecoin Inflows Have Doubled to $98B Amid Selling Pressure

Key Takeaways Stablecoin inflows to crypto exchanges have surged to $98 billion, doubling previous levels amidst heightened market…

Coinbase UK Executive Declares Tokenised Collateral a Mainstream Financial Force

Key Takeaways Tokenised collateral is transitioning from its initial experimental stages into becoming core infrastructure within financial markets.…

After being questioned by Vitalik, L2s are collectively saying goodbye to the "cheap" era

WEEX AI Trading Hackathon Paris Workshop Reveals: How Retail Crypto Traders Can Outperform Hedge Funds

Witness how WEEX's Paris AI Trading Hackathon revealed AI's edge over human traders. Explore key strategies, live competition results & how to build your own AI trading bot.

U.S. Oil (USOR) Price Prediction 2026–2030

Key Takeaways U.S. Oil (USOR) is a speculative Solana-based crypto project that aims to index the United States…

USOR Surges on Meme Narrative Despite No Real-World Asset Backing

Key Takeaways: USOR, a Solana-based token, has seen a notable surge driven by speculative narratives rather than verifiable…

How to Buy U.S. Oil Reserve (USOR) Cryptocurrency

Key Takeaways U.S. Oil Reserve (USOR) is a Solana-based token primarily traded on decentralized exchanges (DEXs). Claims have…

USOR vs Oil ETFs: Understanding Why the ‘Oil Reserve’ Token Doesn’t Track Crude Prices

Key Takeaways The U.S. Oil Reserve (USOR) token has become noteworthy for its claims, yet it does not…

Earn

Earn