USDT Insolvent? Arthur Hayes Publicly Questions Tether

Original Title: "Arthur Hayes Warns of USDT Insolvency Risk, Why the Recent FUD Frenzy?"

Original Author: Azuma, Odaily Star Daily

Following a public feud with Monad, "Big Brother" Arthur Hayes has once again unexpectedly clashed with the stablecoin king Tether.

Arthur Hayes: USDT May Face "Insolvency" Risk

The incident originated on November 30th when Arthur Hayes posted on X regarding Tether's publicly disclosed third-quarter reserves at the end of October. He analyzed that Tether's allocation of volatile assets such as gold and Bitcoin in its reserve assets is too high. USDT may face an "insolvency" risk due to the decline of these assets.

"The Tether team is in the early stages of a massive interest rate trade. Based on my understanding of their audit report, they believe the Fed will start cutting rates, which will significantly compress their interest income. In response, they started buying gold and Bitcoin—ideally, when the 'currency price falls' (rate cut), these assets should rise. But if their gold + Bitcoin position drops by about 30%, Tether's equity will be wiped out, and USDT theoretically will face insolvency."

As shown in the above chart, out of a total of $181.223 billion in Tether's reserve assets, there is a $12.921 billion reserve of precious metals (7.1% share) and a $9.856 billion reserve of Bitcoin (5.4% share)—the combined share of these two assets reaches 12.5% of Tether's total reserve assets.

From Tether's reserve structure, it can be seen that Arthur Hayes may have objectively pointed out a potential extreme scenario that Tether may face. If the gold and Bitcoin reserves simultaneously experience a significant devaluation, theoretically, the value of Tether's reserve assets will not be able to fully cover the issuance scale of USDT.

This point was also mentioned by the well-known rating agency Standard & Poor's last week when downgrading Tether's and USDT's stability ratings, stating "Tether's Bitcoin reserve value accounts for approximately 5.6% of the total USDT circulation volume (Odaily Note: Standard & Poor's here is comparing circulation volume, so the percentage data will be slightly higher than when compared to reserves), exceeding USDT's own 3.9% excess collateralization rate. This means that other low-risk reserve assets (mainly government bonds) are no longer able to fully support the value of USDT. If BTC and other high-risk assets decline in value, it may weaken the coverage ability of USDT's reserves, leading to under-collateralization of USDT."

Is USDT Still Safe?

Arthur Hayes actually described the same situation as Standard & Poor's, but the likelihood of this situation actually occurring is very minimal, for two specific reasons.

· Firstly, it is hard to imagine an instantaneous sharp drop in the price of gold and Bitcoin (referring to a drop of at least several tens of points in a very short period), even in a scenario of sustained decline, Tether theoretically has time to replenish its reserve of low-risk assets by selling.

· Secondly, besides its reserve assets, Tether itself holds a huge amount of proprietary assets, which are sufficient as a reserve buffer pool for USDT to sustain the operation of this cash flow machine.

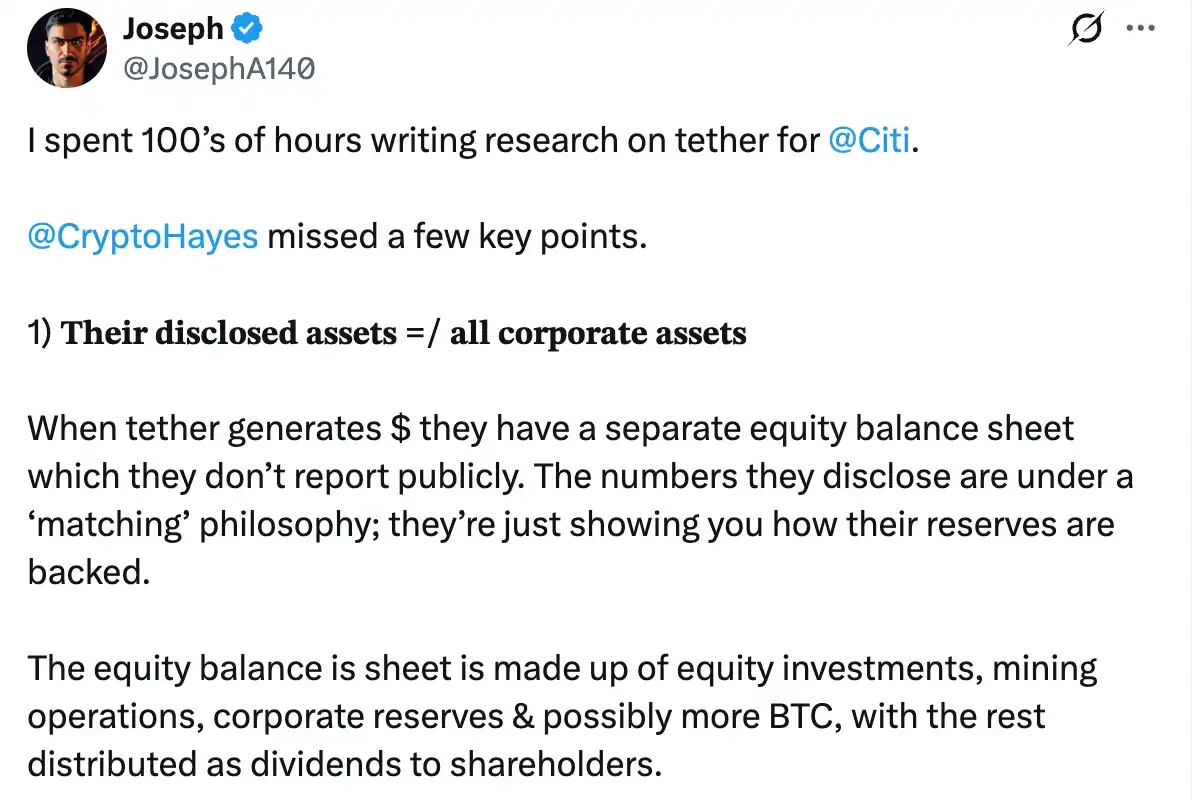

Joseph, former Cryptocurrency Research Head at Citigroup, also mentioned the second point, stating that the assets disclosed by Tether do not represent all of its holdings—when Tether generates profits, they have a separate equity balance sheet that is not publicly disclosed together with the reserve situation; Tether has an extremely strong profitability, and the value of its equity is very high, allowing them to offset any gaps on the balance sheet by selling equity; Tether will not go bankrupt; on the contrary, they have a money-printing machine.

Tether's Response

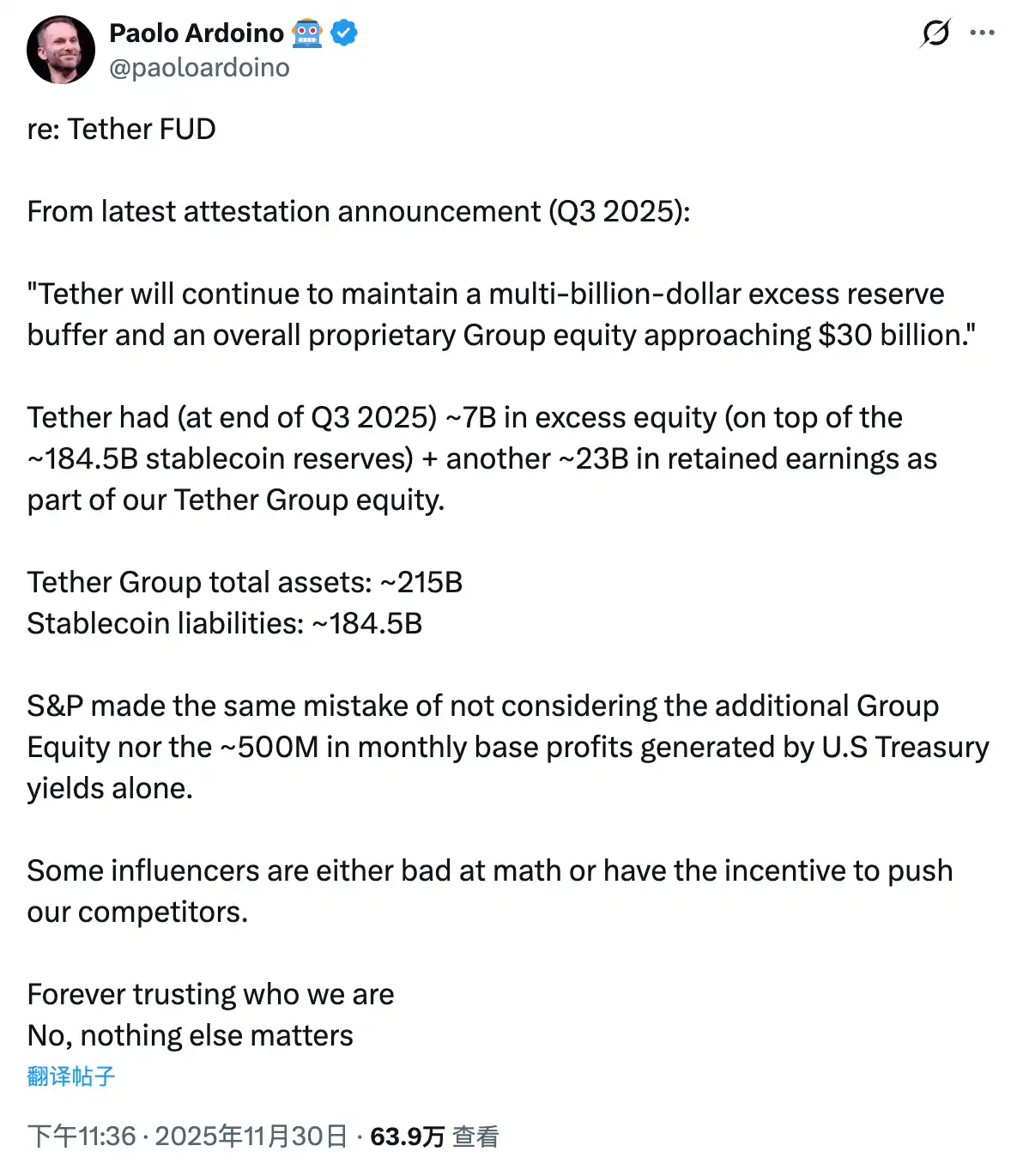

Yesterday evening, as FUD related to this matter escalated, Tether's CEO Paolo Ardoino responded in a post, stating that as of the end of the third quarter of 2025, Tether holds approximately $70 billion in excess equity (beyond the approximately $184.5 billion stablecoin reserves), along with an additional approximately $23 billion in retained earnings, together constituting Tether Group's proprietary equity.

A clear comparison of assets and liabilities:

· Total assets of the Tether Group: approximately $215 billion;

· Stablecoin liabilities: approximately $184.5 billion;

Standard & Poor's also made the same mistake, failing to account for these additional group equities, and not considering the approximately $500 million in basic monthly profits generated solely from U.S. Treasury bond returns.

Interestingly, Paolo Ardoino concluded with a special note: "Some internet celebrities either have poor math skills or impure motives."

· Odaily Note: Arthur Hayes and his family office investment firm Maelstrom are key investors in the interest-bearing stablecoin Ethena (USDe), and have repeatedly predicted that USDe will become the largest stablecoin by issuance volume.

After Paolo Ardoino responded directly, Arthur Hayes also replied again, but his remarks were somewhat sarcastic: "You guys are making so much money, I'm so jealous. Do you have a specific dividend policy? Or a target overcollateralization rate based on asset type (discounted by its volatility)? Obviously, when your liability is in dollars and your asset is U.S. Treasuries, there is no problem, but if your asset is illiquid private investments, in case of an accident, people may question your claim of being overcollateralized."

After this exchange, neither party continued to reply. Arthur Hayes did post a dynamic this morning, but it was just about calling a bounce in the market.

From the photos shared by Arthur Hayes, after ranting about Monad and Tether in succession, his mood seemed quite good...

You may also like

Who's at the CFTC Table? A Rebalancing of American Fintech Discourse

AI Trading vs Human Crypto Traders: $10,000 Live Trading Battle Results in Munich, Germany (WEEX Hackathon 2026)

Discover how AI trading outperformed human traders in WEEX's live Munich showdown. Learn 3 key strategies from the battle and why AI is changing crypto trading.

Elon Musk's X Money vs. Crypto's Synthetic Dollars: Who Wins the Future of Money?

How do Synthetic Dollars work? This guide explains their strategies, benefits over traditional stablecoins like USDT, and risks every crypto trader must know.

The Israeli military is hunting a mole on Polymarket

Q4 $667M Net Loss: Coinbase Earnings Report Foreshadows Challenging 2026 for Crypto Industry?

BlackRock Buying UNI, What's the Catch?

Lost in Hong Kong

Gold Plunges Over 4%, Silver Crashes 11%, Stock Market Plummet Triggers Precious Metals Algorithmic Selling Pressure?

Coinbase and Solana make successive moves, Agent economy to become the next big narrative

Aave DAO Wins, But the Game Is Not Over

Coinbase Earnings Call, Latest Developments in Aave Tokenomics Debate, What's Trending in the Global Crypto Community Today?

ICE, the parent company of the NYSE, Goes All In: Index Futures Contracts and Sentiment Prediction Market Tool

On-Chain Options: The Crossroads of DeFi Miners and Traders

How WEEX and LALIGA Redefine Elite Performance

WEEX x LALIGA partnership: Where trading discipline meets football excellence. Discover how WEEX, official regional partner in Hong Kong & Taiwan, brings crypto and sports fans together through shared values of strategy, control, and long-term performance.

Best Crypto to Buy Now February 10 – XRP, Solana, Dogecoin

Key Takeaways XRP is set to revolutionize cross-border transactions, potentially reaching $5 by the end of Q2 with…

Kyle Samani Criticizes Hyperliquid in Explosive Post-Departure Market Commentary

Key Takeaways: Kyle Samani, former co-founder of Multicoin Capital, publicly criticizes Hyperliquid, labeling it a systemic risk. Samani’s…

Leading AI Claude Forecasts the Price of XRP, Cardano, and Ethereum by the End of 2026

Key Takeaways: XRP’s value is projected to reach $8 by 2026 due to major institutional adoption. Cardano (ADA)…

Bitcoin Price Prediction: Alarming New Research Cautions Millions in BTC at Risk of ‘Quantum Freeze’ – Are You Ready?

Key Takeaways Quantum Threat to Bitcoin: The rise of quantum computing presents a unique security challenge to Bitcoin,…

Who's at the CFTC Table? A Rebalancing of American Fintech Discourse

AI Trading vs Human Crypto Traders: $10,000 Live Trading Battle Results in Munich, Germany (WEEX Hackathon 2026)

Discover how AI trading outperformed human traders in WEEX's live Munich showdown. Learn 3 key strategies from the battle and why AI is changing crypto trading.

Elon Musk's X Money vs. Crypto's Synthetic Dollars: Who Wins the Future of Money?

How do Synthetic Dollars work? This guide explains their strategies, benefits over traditional stablecoins like USDT, and risks every crypto trader must know.