Why Bitcoin Is Falling Now: The Real Reasons Behind BTC's Crash & WEEX's Smart Profit Playbook

The crypto market has entered a period of heightened volatility and uncertainty during the past days, capturing global attention as Bitcoin (BTC) experiences dramatic price swings. Following the highs of late 2025, traders are now navigating sharp corrections, large-scale liquidations, and fluctuating sentiment across exchanges. For investors and traders alike, understanding the drivers behind such volatility is crucial not only to manage risk but also to uncover potential opportunities in this evolving landscape. This article breaks down the current crypto market conditions, explores the reasons behind recent price movements, and highlights ways WEEX users can generate stable returns even amid uncertainty.

Bitcoin on the Brink: $1.35B Liquidations & Extreme Fear Signals (What's Next?)

Bitcoin (BTC) has been trading around $65,000, with volatility intensifying in recent sessions. The Crypto Fear & Greed Index currently stands at 5, signaling extreme fear across the market. According to Glassnode, over the past 24 hours, BTC short liquidations exceeded $1.35 billion, reflecting a sharp reaction from highly leveraged positions.

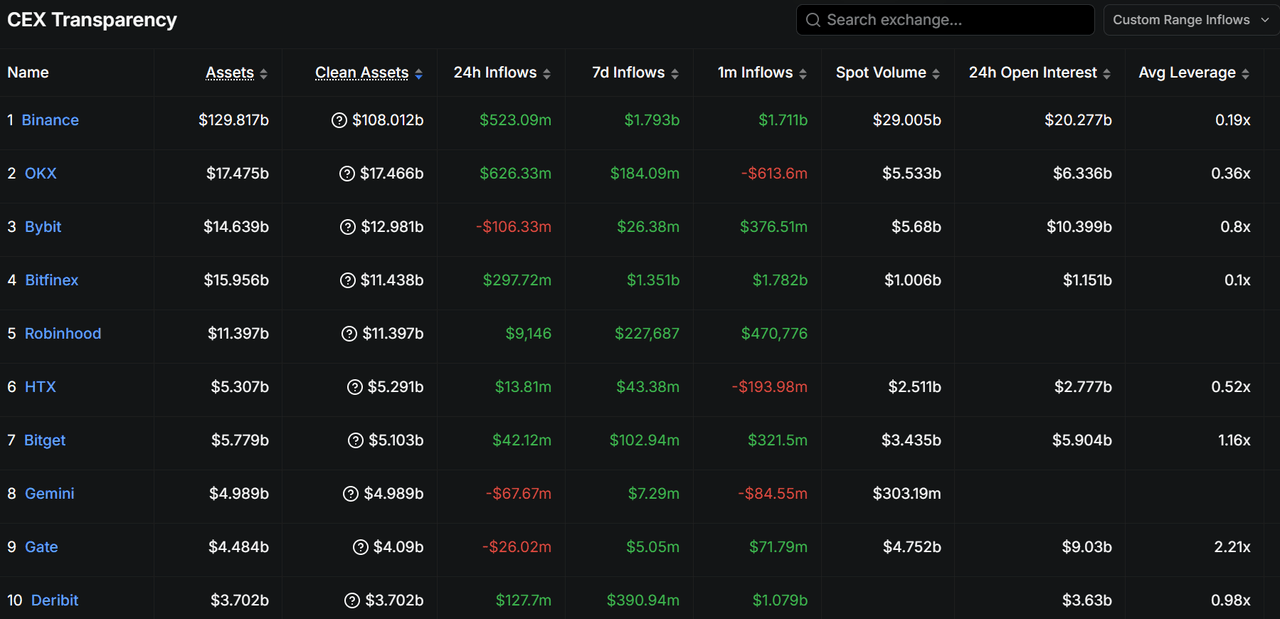

Meanwhile, based on data from Defillama, centralized exchanges (CEXs) have seen significant inflows over the past week, indicating that investors are moving funds into exchanges either to sell or hedge their positions. Despite the turbulence, Bitcoin remains a key benchmark for the broader crypto ecosystem, with sentiment swinging dramatically as traders weigh both short-term risks and long-term opportunities.

The 5 Hidden Forces Crushing Bitcoin Price (Beyond Just Macro)

The ongoing Bitcoin sell-off has stunned markets, entering one of the most oversold zones in history without a clearly identifiable “black swan” event. While the broad downward direction aligns with macroeconomic shifts—hawkish Fed expectations, tightening liquidity, and forced deleveraging—closer inspection reveals a far more complex interplay of factors.

Force 1: The Fed's Silent Liquidity Squeeze

The U.S. Federal Reserve’s leadership changes, including expectations of balance sheet reduction under Kevin Warsh, heightened market-wide risk-off sentiment. Globally, the era of ultra-low interest rates and abundant liquidity that underpinned speculative positioning is over. Large institutional players, including sovereign wealth funds and pension funds, are facing cash flow pressures amid high capital commitments, particularly to AI and digital transformation projects. As these “deep-pocket” investors prioritize liquidity, risk assets like Bitcoin become prime candidates for rapid liquidation, creating systemic downward pressure.

Force 2: Asia's $10B Leverage Time Bomb

Analysts, including Pantera Capital’s Franklin Bi, speculate that recent BTC turbulence may stem from non-crypto-native Asian entities executing highly leveraged trades. Complex positions—such as leverage on Binance paired with JPY arbitrage—have experienced forced unwindings due to shifting interest rates and a sudden liquidity crunch. The resulting capital extraction can spill over into crypto markets, amplifying declines. This aligns with observed sharp BTC moves during Asian trading hours, reflecting a cross-market, leverage-driven spiral.

Force 3: Bitcoin ETF's Dark Pool Effect

Unusual activity in BlackRock’s spot Bitcoin ETF (IBIT) has further intensified volatility. On February 5, IBIT saw record trading volume of $10.7B and options premiums hitting $900M, suggesting that a large holder may have faced forced liquidation. Concentrated positions, especially by Hong Kong-based funds heavily invested in IBIT, can exacerbate sharp swings when collateralized positions are unwound rapidly.

Force 4: OG Holders' Panic Exodus

Crypto-native holders, including long-standing OG investors, have historically reacted to fear and uncertainty in a highly synchronized manner. Panic selling, combined with FOMO-driven liquidations and misaligned expectations regarding ETF participation, contributed to short-term downward spirals. While recent on-chain data indicates OG selling pressure is easing, earlier movements intensified the sense of market fragility.

Force 5: The Looming Government BTC Dump

Speculation around large-scale sales of seized BTC by U.S. and UK authorities persist, though there is no on-chain evidence yet. Assets previously confiscated—such as the 127,000 BTC seized from the collapsed Prince Group—remain potential sources of latent selling pressure. Even the expectation of such liquidations can exacerbate market anxiety, contributing to the cascading sell-offs.

In sum, this downturn is not the result of a single catalyst but a convergence of macroeconomic tightening, cross-market leverage unwinds, concentrated ETF and options positions, speculative behavioral dynamics, and latent institutional or custodial pressures. Each factor, acting in concert, has driven Bitcoin into one of its most volatile corrections in recent memory, highlighting both the complexity and fragility of crypto markets in the current macro-financial environment.

Turn Crypto Volatility Into Profit: WEEX's Auto Earn & Trade to Earn Strategies for Stable Crypto Returns

For traders and investors navigating high-volatility crypto markets, WEEX provides opportunities to earn consistent returns. WEEX Auto Earn allows users to deposit assets such as USDT and start generating interest automatically, without locking funds. Interest is calculated daily and distributed seamlessly, keeping capital active for trading while earning passively.

In parallel, WEEX Trade to Earn rewards futures trading with tiered mining incentives and real-time transaction fee rebates in WXT. The more you trade, the higher your rebate rate, reaching up to 40% for advanced tiers, further amplified by periodic WXT burns. Together, these tools empower users to stabilize income and reduce trading costs, even amid sharp market corrections, turning volatility into an opportunity for disciplined, strategic growth.

Bitcoin's Support & Historical Trends: Why WEEX Users Can Stay Confident Amid Market Uncertainty

Despite recent turbulence, the Bitcoin market is showing clear support levels around $60,000–$65,000, with rebounds already observed after forced liquidations. Historical patterns suggest that periods of extreme fear often precede consolidation and future growth.

For WEEX users, leveraging tools like Auto Earn and Trade to Earn ensures that your capital remains productive while positioning for the next market upswing. The current environment is challenging, but it is also a time for disciplined strategies, calculated trades, and smart risk management. Stay informed, stay agile, and trust that with WEEX’s integrated ecosystem, you can navigate volatility while earning and growing in the evolving crypto landscape.

About WEEX

Founded in 2018, WEEX has developed into a global crypto exchange with over 6.2 million users across more than 150 countries. The platform emphasizes security, liquidity, and usability, providing over 1,200 spot trading pairs and offering up to 400x leverage in crypto futures trading. In addition to traditional spot and derivatives markets, WEEX is expanding rapidly in the AI era — delivering real-time AI news, empowering users with AI trading tools, and exploring innovative trade-to-earn models that make intelligent trading more accessible to everyone. Its 1,000 BTC Protection Fund further strengthens asset safety and transparency, while features such as copy trading and advanced trading tools allow users to follow professional traders and experience a more efficient, intelligent trading journey.

Follow WEEX on social media

Instagram: @WEEX Exchange

TikTok: @weex_global

YouTube: @WEEX_official

Discord: WEEX Community

Telegram: WeexGlobal Group

You may also like

Wall Street's Hottest Trades See Exodus

Vitalik Discusses Ethereum Scaling Path, Circle Announces Partnership with Polymarket, What's the Overseas Crypto Community Talking About Today?

Believing in the Capital Markets - The Essence and Core Value of Cryptocurrency

Polymarket's 'Weatherman': Predict Temperature, Win Million-Dollar Payout

$15K+ Profits: The 4 AI Trading Secrets WEEX Hackathon Prelim Winners Used to Dominate Volatile Crypto Markets

How WEEX Hackathon's top AI trading strategies made $15K+ in crypto markets: 4 proven rules for ETH/BTC trading, market structure analysis, and risk management in volatile conditions.

A nearly 20% one-day plunge, how long has it been since you last saw a $60,000 Bitcoin?

Raoul Pal: I've seen every single panic, and they are never the end.

Key Market Information Discrepancy on February 6th - A Must-Read! | Alpha Morning Report

2026 Crypto Industry's First Snowfall

The Harsh Reality Behind the $26 Billion Crypto Liquidation: Liquidity Is Killing the Market

Why Is Gold, US Stocks, Bitcoin All Falling?

Key Market Intelligence for February 5th, how much did you miss out on?

Wintermute: By 2026, crypto had gradually become the settlement layer of the Internet economy

Tether Q4 2025 Report: USDT Market Cap Nears $190 Billion, Multiple Metrics Reach All-Time Highs

Kyle Samani's about-face, one of the biggest believers in web3, has also left the industry

Bhutan Quietly Sells Over $22M in Bitcoin, Drawing Speculation Over Possible Moves

Key Takeaways Bhutan has transferred over $22 million in Bitcoin from sovereign wallets in the past week. The…

BitMine Endures a $7B Unrealized Loss as Ethereum Dips Below $2,100

Key Takeaways BitMine is facing a significant financial challenge with an unrealized loss of over $7 billion in…

Trump-Linked World Liberty Financial Under Scrutiny Following $500 Million UAE Stake

Key Takeaways A U.S. House investigation is examining a $500 million UAE stake in Trump-related World Liberty Financial.…

Wall Street's Hottest Trades See Exodus

Vitalik Discusses Ethereum Scaling Path, Circle Announces Partnership with Polymarket, What's the Overseas Crypto Community Talking About Today?

Believing in the Capital Markets - The Essence and Core Value of Cryptocurrency

Polymarket's 'Weatherman': Predict Temperature, Win Million-Dollar Payout

$15K+ Profits: The 4 AI Trading Secrets WEEX Hackathon Prelim Winners Used to Dominate Volatile Crypto Markets

How WEEX Hackathon's top AI trading strategies made $15K+ in crypto markets: 4 proven rules for ETH/BTC trading, market structure analysis, and risk management in volatile conditions.

Earn

Earn