X Pulls the Plug — the Era of “Talking Your Way to Traffic” Comes to an End.

Source: TechFlow (Shenchao)

X has shut down “tweet-to-earn.”

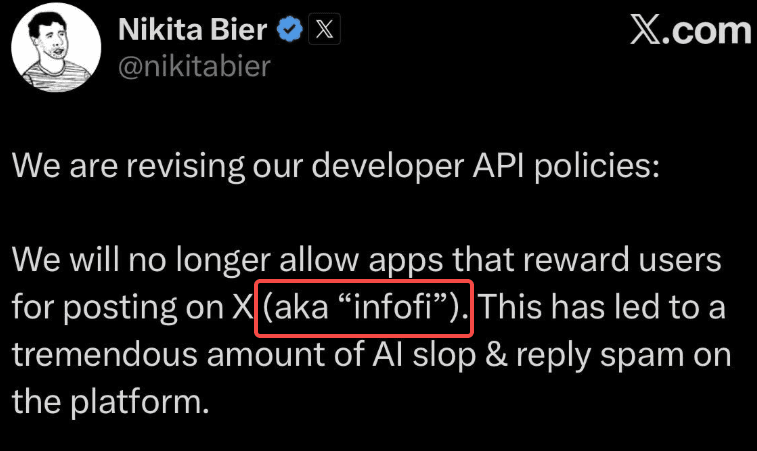

Yesterday, X’s Head of Product Nikita Bier announced that any application that rewards users for posting will have its API access revoked.

He added—almost considerately—that affected developers are welcome to contact the team, and X will help them migrate to Threads or Bluesky.

“The landlord kicks you out—and even helps arrange the moving truck.”

As soon as the news broke, the InfoFi sector collapsed across the board. KAITO fell by 20%, Cookie dropped by 20%, and the Kaito Yappers community, with 157,000 members, was shut down entirely.

Less than an hour later, Kaito founder Yu Hu published a long-form statement.

The post contained no apology to the community and no protest against X’s policy change. Its core message was straightforward:

Move elsewhere.

Yaps is being discontinued. The new product is called Kaito Studio, which will follow a more traditional marketing model—one-to-one partnerships between brands and creators—moving away from the open, points-farming system where anyone could participate.

Twitter is no longer the priority. The focus will shift to YouTube and TikTok.

The crypto niche is no longer the sole target either; the expansion is toward finance, AI, and the broader creator economy—a market worth USD 200 billion.

The product is ready.

The direction is clear.

The data is in place.

And a new narrative has been formed.

Still, this does not feel like an emergency response written within an hour. It feels more like something prepared in advance—kept in a drawer, waiting for X to make the first move.

At the same time, there were earlier signals on-chain.

Kaito’s multisig contract previously distributed 24 million KAITO tokens to five addresses. One of those addresses transferred 5 million KAITO in full to Binance a week ago.

It looks far more like a cash-out at the right moment.

Advance communication.

Advance drafting.

Advance transfer of tokens to exchanges.

Everything that needed to be done was done.

Then, once X made the announcement, the long statement followed immediately—polished, composed, framed as a proactive pivot and an embrace of change.

In the statement, Yu Hu wrote:

“After discussions with X, both parties agreed that a fully permissionless distribution system is no longer viable.”

Agreed.

Being kicked out is reframed as “reaching consensus.”

A product being effectively terminated is repackaged as a strategic upgrade.

This kind of rhetoric is all too familiar in crypto.

Projects never say, “We failed.”

They say they are exploring new possibilities.

They say market conditions have changed.

They say this is a planned transition.

It sounds graceful—but it is also pure PR.

At its core, X’s ban was merely the final blow. The “tweet-to-earn” model was already on its way out.

Mining by posting sounds appealing: tokenizing attention, fairly compensating creators, building a decentralized information economy.

But once deployed in reality, everyone knows how it played out.

If rewards are tied to posting, people post more.

If AI can generate content at scale, AI does the posting.

If accounts are unlimited, people spin up endless alts.

According to CryptoQuant, on January 9 alone, bots generated 7.75 million crypto-related tweets on X, a year-over-year increase of 1,224%.

ZachXBT had already been criticizing this last year, calling InfoFi platforms the primary drivers of AI-generated spam. He even offered a USD 5,000 bounty for user data to identify bot networks.

Genuine discussion was drowned out by endless “GM,” “LFG,” and “bullish.” Humans and bots blended together to the point where telling them apart became nearly impossible.

X’s Head of Product, Nikita Bier, had already posted a warning last week:

“CT is dying from suicide, not from the algorithm.”

Crypto Twitter is killing itself—it isn’t being killed by the algorithm.

At the time, the crypto community mocked him for arrogance and responded with GM memes.

Looking back now, doesn’t it feel like a notice issued before an execution?

Addressing spam, Yu Hu said Kaito had tried everything: raising thresholds, adding filters, redesigning incentives.

None of it worked.

The moment you reward posting with tokens, you are effectively offering a bounty for noise. No threshold can outpace profit-driven behavior. Human incentives are straightforward: as long as rewards exist, spam will not stop.

More critically, the lifeline was never in their own hands.

What business was Kaito really in?

Leveraging X’s traffic, using tokens to incentivize content production, and selling the resulting data to projects for marketing.

X was the foundation. Kaito was the structure built on top.

The moment the owner of the foundation decides to reclaim it, the building collapses. No justification required. No negotiation needed. A single announcement is enough.

InfoFi claims to be about a decentralized attention economy. But the attention layer was never decentralized. The algorithm belongs to the platform. The API belongs to the platform. The users belong to the platform.

You can put points on-chain.

You can decentralize the token.

But you cannot decentralize Twitter.

A parasite attempting to overthrow its host does not trigger a revolution. The host simply pulls the plug.

Over the past few years, Web3 startups have repeatedly pursued this model: borrow Web2 traffic to build Web3 momentum. Users remain on Twitter. Data remains on Twitter. Attention remains on Twitter. But the token is self-issued, and the revenue flows inward.

It sounds clever—using leverage to achieve scale.

But someone else’s traffic will always belong to someone else. Platforms tolerate you only until you become inconvenient. Once you do, parasitic business models collapse instantly.

This should serve as a warning to every Web3 project built on borrowed platform traffic.

If your lifeline is controlled by someone else, then every dollar you earn exists only because it hasn’t yet been taken back.

Ask yourself whether you are building a company—or renting a room.

Renters should not think like landlords, and they certainly should not believe the house is theirs.

Kaito says it will move to YouTube and TikTok next.

But are those landlords really easier to negotiate with than Musk?

You may also like

Key Market Intelligence for February 5th, how much did you miss out on?

Wintermute: By 2026, crypto had gradually become the settlement layer of the Internet economy

Tether Q4 2025 Report: USDT Market Cap Nears $190 Billion, Multiple Metrics Reach All-Time Highs

Kyle Samani's about-face, one of the biggest believers in web3, has also left the industry

Bhutan Quietly Sells Over $22M in Bitcoin, Drawing Speculation Over Possible Moves

Key Takeaways Bhutan has transferred over $22 million in Bitcoin from sovereign wallets in the past week. The…

BitMine Endures a $7B Unrealized Loss as Ethereum Dips Below $2,100

Key Takeaways BitMine is facing a significant financial challenge with an unrealized loss of over $7 billion in…

Trump-Linked World Liberty Financial Under Scrutiny Following $500 Million UAE Stake

Key Takeaways A U.S. House investigation is examining a $500 million UAE stake in Trump-related World Liberty Financial.…

Asia Market Open: Bitcoin Tumbles as Asian Equities Reflect Global Tech Retreat

Key Takeaways: Bitcoin’s price plunged by 6% to $72,000, reflecting the spillover effects from the global tech sector’s…

Crypto Firms Propose Concessions to Banks as Stablecoin Disputes Stall Key Crypto Bill

Key Takeaways: Crypto companies are attempting to navigate stablecoin disputes with banks but agreements remain elusive. Industry representatives…

CoolWallet Introduces TRON Energy Rental to Minimize TRX Transaction Costs

Key Takeaways CoolWallet has integrated TRON’s energy rental services, offering users lower transaction fees while maintaining asset security.…

CFTC Officially Withdraws Biden-Era Proposal to Ban Political and Sports Prediction Markets

Key Takeaways: The CFTC has rescinded a 2024 proposal and subsequent 2025 advisory that aimed to prohibit event…

Binance Says Assets Rose Amid Alleged Bank Run Attempt

Key Takeaways: Binance reported an unexpected increase in assets during a community-driven withdrawal campaign, challenging conventional expectations of…

Same Macro Tape, Different Bid – Gold Absorbs Flows as Bitcoin Swings

Key Takeaways: Gold is experiencing significant demand growth, especially via ETFs and central banks, projecting a robust performance…

Crypto Price Prediction Today, February 4 – Focus on XRP, Cardano, and Dogecoin

Key Takeaways Bitcoin is facing significant pressure, affecting the entire cryptocurrency market, including heavyweights like XRP, Cardano, and…

Vitalik Buterin Urges Ethereum Builders to Innovate Beyond Clone Chains

Key Takeaways Vitalik Buterin criticizes the trend of creating copy-paste EVM chains, encouraging developers to focus on truly…

Best Crypto to Buy Now February 4: XRP, Solana, Hyperliquid Picks

Key Takeaways XRP remains one of the top picks for cross-border transactions due to its high speed and…

XRP Price Prediction: Ripple Quietly Unlocks a Billion Tokens – Is a Price Shock Coming in the Next Few Hours?

Key Takeaways Ripple has released one billion XRP tokens into the market, potentially causing a shift in XRP…

Google’s Gemini AI Predicts the Price of XRP, Ethereum, and Solana By the End of 2026

Key Takeaways Google’s Gemini AI forecasts significant growth for XRP, anticipating a price of up to $8 by…

Key Market Intelligence for February 5th, how much did you miss out on?

Wintermute: By 2026, crypto had gradually become the settlement layer of the Internet economy

Tether Q4 2025 Report: USDT Market Cap Nears $190 Billion, Multiple Metrics Reach All-Time Highs

Kyle Samani's about-face, one of the biggest believers in web3, has also left the industry

Bhutan Quietly Sells Over $22M in Bitcoin, Drawing Speculation Over Possible Moves

Key Takeaways Bhutan has transferred over $22 million in Bitcoin from sovereign wallets in the past week. The…

BitMine Endures a $7B Unrealized Loss as Ethereum Dips Below $2,100

Key Takeaways BitMine is facing a significant financial challenge with an unrealized loss of over $7 billion in…

Earn

Earn